Accounting Methods

Cash vs. Accrual Accounting

TaxBridge supports both cash and accrual accounting methods. The choice between these methods affects when income and expenses are recognized in your financial reports and tax filings.

Definition: Income and expenses are recorded when cash is actually received or paid.

Income Recognition

Income is recorded when payment is received from customers, regardless of when the work was performed.

Expense Recognition

Expenses are recorded when bills are paid, regardless of when the expense was incurred.

Example

If you send an invoice in December 2023 but receive payment in January 2024, the income is recorded in 2024 under cash accounting.

Definition: Income and expenses are recorded when they are earned or incurred, regardless of when cash changes hands.

Income Recognition

Income is recorded when it is earned (when you send an invoice), not when payment is received.

Expense Recognition

Expenses are recorded when they are incurred (when you receive a bill), not when you pay them.

Example

If you send an invoice in December 2023 but receive payment in January 2024, the income is recorded in 2023 under accrual accounting.

How TaxBridge Handles Both Methods

TaxBridge gives you the flexibility to view and export your financial data using either cash or accrual basis accounting:

When you sync your QuickBooks data, TaxBridge can generate reports using both cash and accrual methods. This lets you compare the financial results under each method and make informed decisions about your tax strategy.

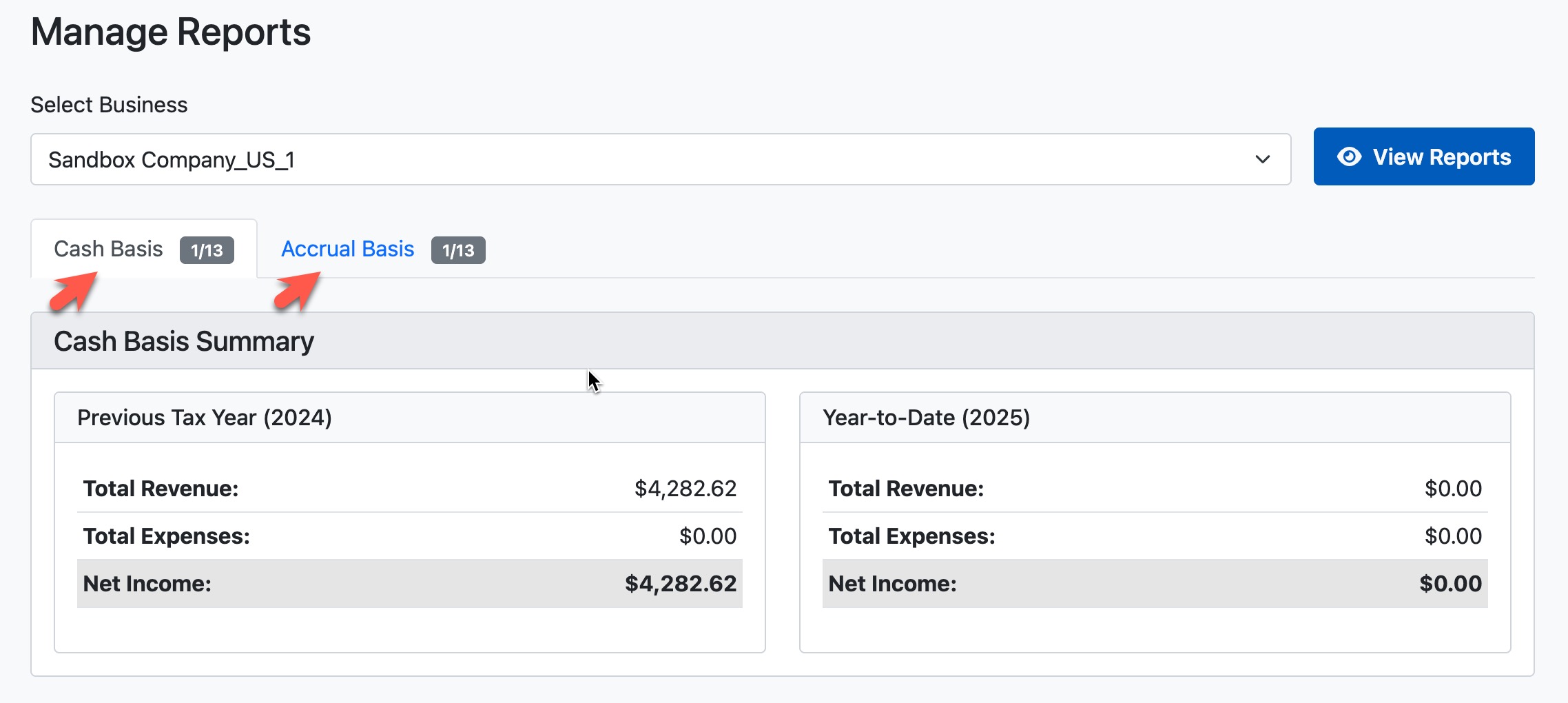

Use the tabs in the Reports section to switch between Cash and Accrual basis views.

When exporting data for tax purposes, you can select which accounting method to use. This gives you the flexibility to meet your specific tax filing requirements.

Tax Implications

The choice of accounting method can have significant tax implications:

| Consideration | Cash Basis | Accrual Basis |

|---|---|---|

| Tax Timing | Can sometimes defer tax payments by delaying income recognition | May accelerate tax payments by recognizing income before payment is received |

| Business Fluctuations | May show more volatile income patterns | Generally provides a smoother picture of business performance |

| Financial Decision Making | Simpler to understand cash flow | Better for understanding overall business profitability |

| IRS Requirements | Generally acceptable for smaller businesses | Required for businesses with inventory or with over $25 million in gross receipts |

Which Method Should You Use?

- You run a service-based business with no inventory

- You're a small business or sole proprietor

- You want simplicity in tracking income and expenses

- Your business has less than $25 million in gross receipts

- You want to manage taxes by controlling when you receive payments or pay expenses

- Your business carries inventory

- You have gross receipts over $25 million

- You want a more accurate picture of your business profitability

- You extend credit to customers or receive credit from vendors

- You're planning to seek outside financing or investors

- You want to match revenue with the expenses incurred to generate that revenue

Common Questions

Yes, but it requires IRS approval. You'll need to file Form 3115, Application for Change in Accounting Method. The change can have tax implications, so consult with a tax professional before proceeding.

TaxBridge can generate reports in both cash and accrual basis regardless of your QuickBooks settings. QuickBooks stores transaction data in a way that allows conversion between methods.

A hybrid method uses elements of both cash and accrual accounting. While TaxBridge doesn't directly support hybrid methods, you can manually adjust your data after export if you use this approach. Consult with a tax professional for guidance on hybrid methods.